In an interesting turn of events, the price of Bitcoin witnessed a resurgence over the past week, with the premier cryptocurrency aiming for the $50,000 level again. The premier cryptocurrency seems to have overcome the travails that saw its price drop below $40,000 after the approval of spot ETF trading in the United States.

The latest on-chain revelations have offered insight into what has been going on behind the scenes following BTC’s price surge to its recent highs.

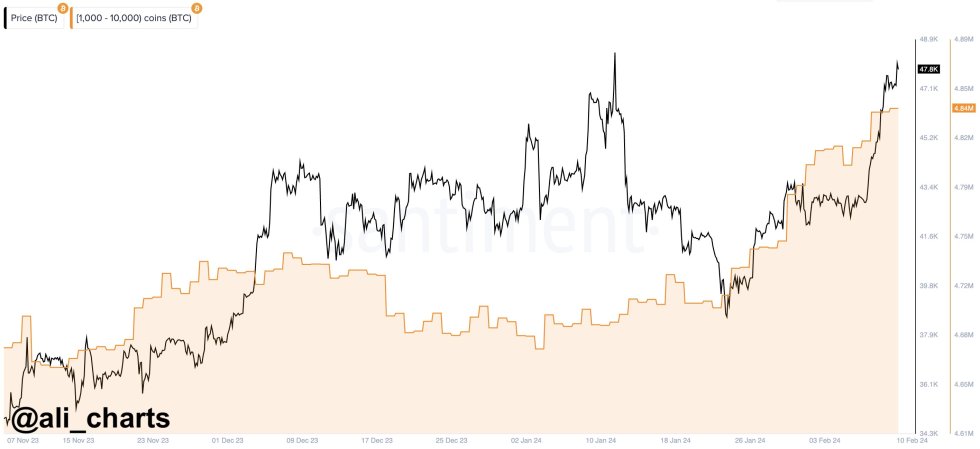

Whales Accumulate 140,000 BTC In Three Weeks

In a post on the X platform, popular crypto analyst Ali Martinez revealed that a particular class of Bitcoin investors have been on an accumulation spree in recent weeks. The relevant metric here is the total number of coins held by whales, holding between 1,000 and 10,000 BTC.

According to data from on-chain analytics firm Santiment, whales holding between 1,000 and 10,000 BTC have added more than 140,000 coins in the last three weeks (equivalent to a whopping $6.16 billion).

This recent acquisition brings the total amount of Bitcoin the highlighted whale class holds to 4.84 million BTC. Such large-scale purchases often suggest a strong conviction and faith in the world’s largest cryptocurrency.

The timing of this spike in the buying activity of whales is also interesting, as it coincides with a period of increased interest from institutional players. Recently, Bitcoinist reported that the new Bitcoin spot ETF issuers have collectively accumulated over 200,000 BTC in assets under management.

What’s more, the surge in whale activity paints a bullish picture for the premier cryptocurrency, especially as investors are optimistic about the Bitcoin price hitting $50,000.

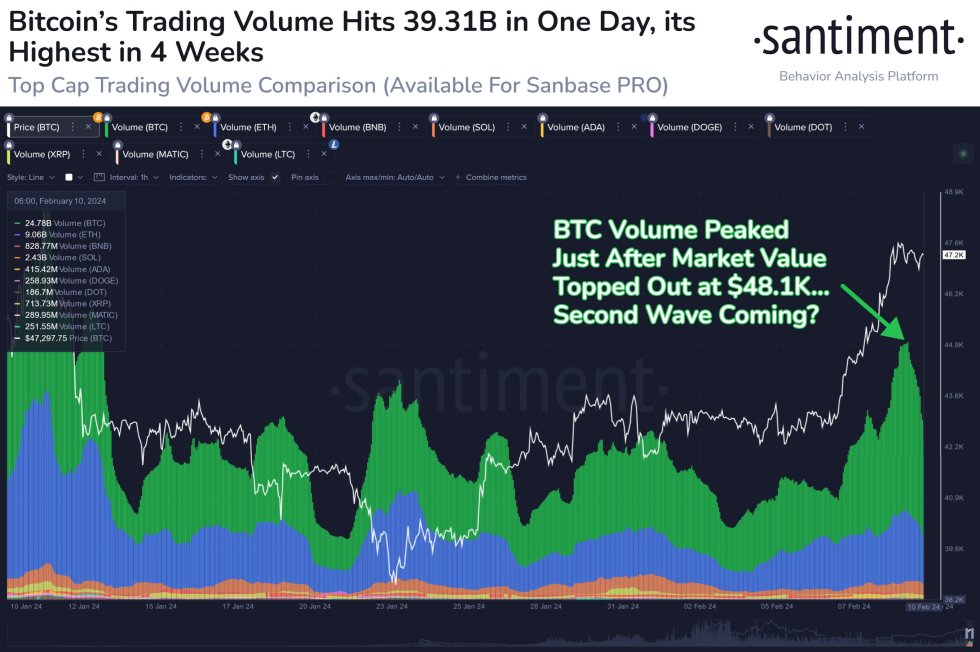

Bitcoin’s Trading Volume Hits 4-Week High

As of this writing, Bitcoin is valued at $47,715, reflecting a mere 0.8% price increase in the past day. According to data from CoinGecko, the flagship cryptocurrency has jumped by more than 12% in the last seven days.

In a recent post on X, Santiment revealed that Bitcoin hit a 4-week high in terms of trading volume in the past week. The on-chain analytics platform attributed the single-day trading volume of $39.31 billion to the recent price boost experienced by BTC.

The trading volumes of other high-cap assets, on the other hand, have been relatively quiet, according to Santiment. Ethereum’s trading volume was an exception, though, having witnessed a substantial price surge of its own.

from Bitcoinist.com https://ift.tt/SKZnckN

0 Comments