As the first week of October unfolds, the fast-paced Bitcoin and crypto space is set for another blockbuster week, with several pivotal events on the horizon. From regulatory advancements, and historical trend analyses, to macroeconomic influences, the market is set to witness a whirlwind of events that could shape the future price trajectory.

#1 Launch Of Ethereum Futures ETFs

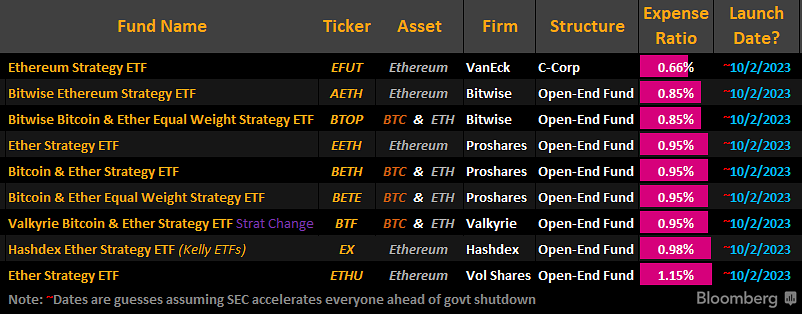

A slew of Ethereum futures ETFs is set to debut this week, as evidenced by recent announcements and market speculations. Valkyrie, a renowned asset manager, confirmed on Friday its plans to revamp its Bitcoin futures ETF into a blended financial product encompassing both BTC and ETH futures. In a similar vein, VanEck has announced its unique ETF proposition.

Experts at Bloomberg, who closely monitor the ETF market, have hinted at a potential launch on Monday. However, an official nod from the SEC is still awaited. James Seyffart, an ETF analyst with Bloomberg, took to Twitter on Friday, commenting, “OKAY: This looks to be the full list of Ethereum Futures ETFs that will be given SEC accelerated approval to launch on Monday… It’s gonna be a crazy day to say the least.”

Eric Balchunas, Senior ETF Analyst for Bloomberg, echoed similar sentiments on Saturday, “Alright we got NINE funds ready to go in the Ether Futures ETF Derby which begins at 9:30 am Monday. Gonna be a fascinating experiment and great foreshadow/undercard to the spot race.”

While these approvals might sound bullish for Ethereum, a look back at Bitcoin’s Future ETF approval in late 2021 draws a more complex picture. The launch coincided with BTC’s peak price in 2021. Hence, whether Ether (ETH) will experience a post-approval price surge is uncertain. It’s also noteworthy that the Ethereum futures will be settled in cash, rather than in actual ETH, further complicating the price projections.

#2 Bitcoin Heading Into “Uptober”

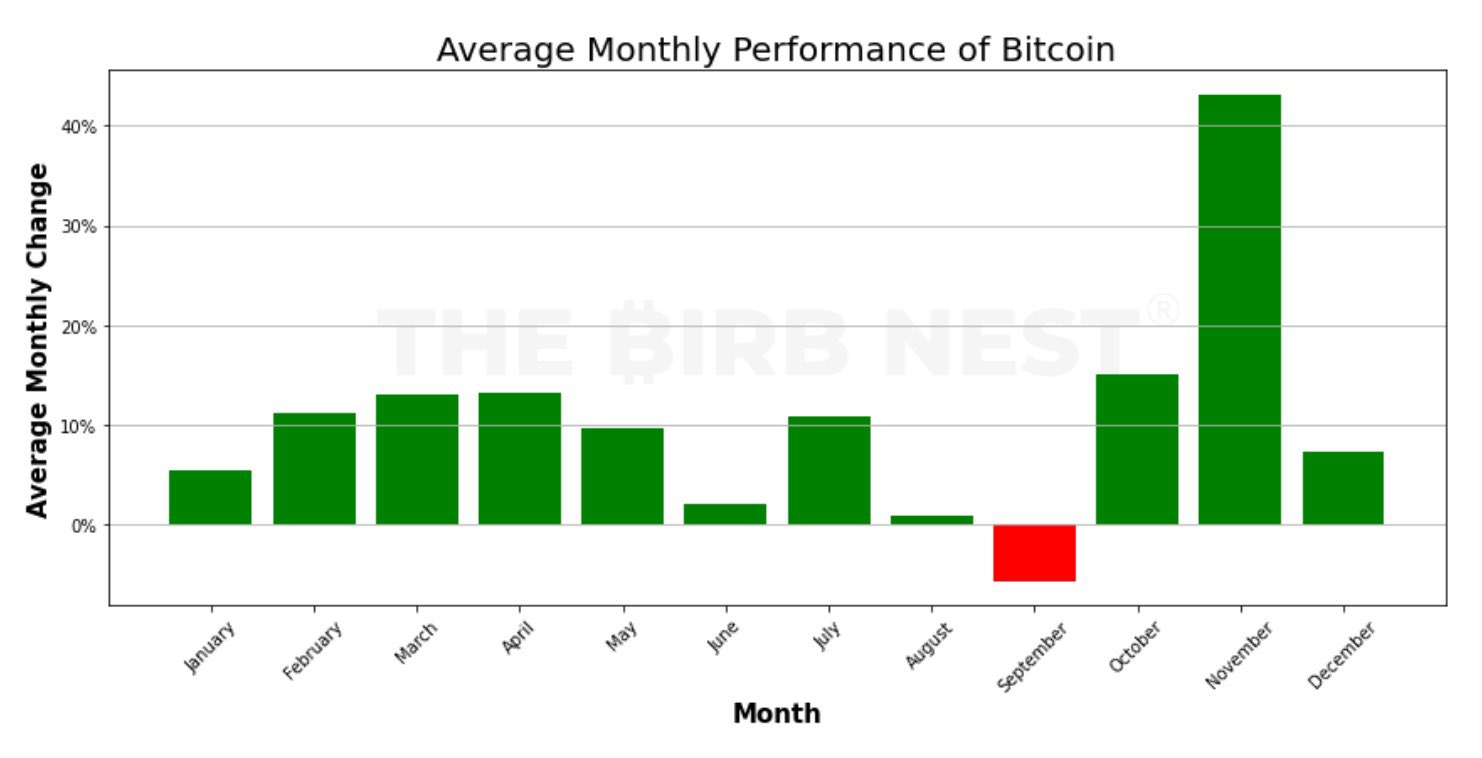

September concluded with Bitcoin enthusiasts celebrating an unusual achievement. For the first time in seven years, Bitcoin did not experience a “Rektember” and ended the month in positive territory, notching up a gain of 4.27%. This uptick has ignited renewed hope and optimism, particularly considering Bitcoin’s historically lackluster performance in September.

BTC’s recent performance, coupled with its historical data, has prompted many market experts to anticipate a buoyant October, now colloquially termed “Uptober.” Crypto Analyst Miles Deutscher weighed in on this discussion through his recent tweet, emphasizing, “Historically, October + November are the best performing months for Bitcoin.”

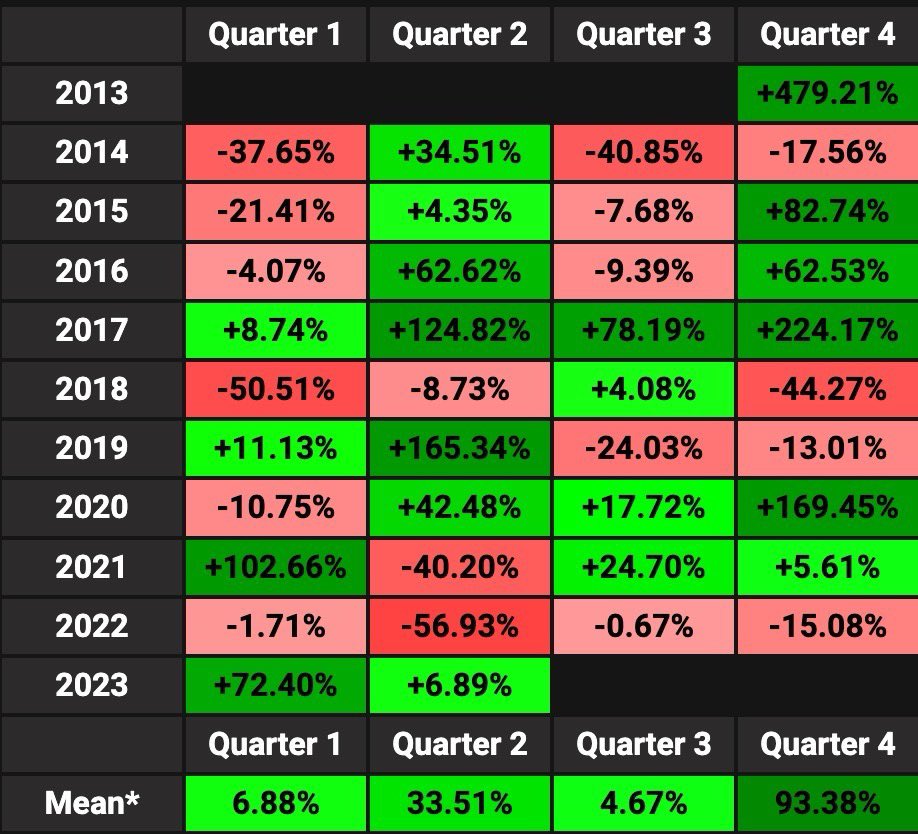

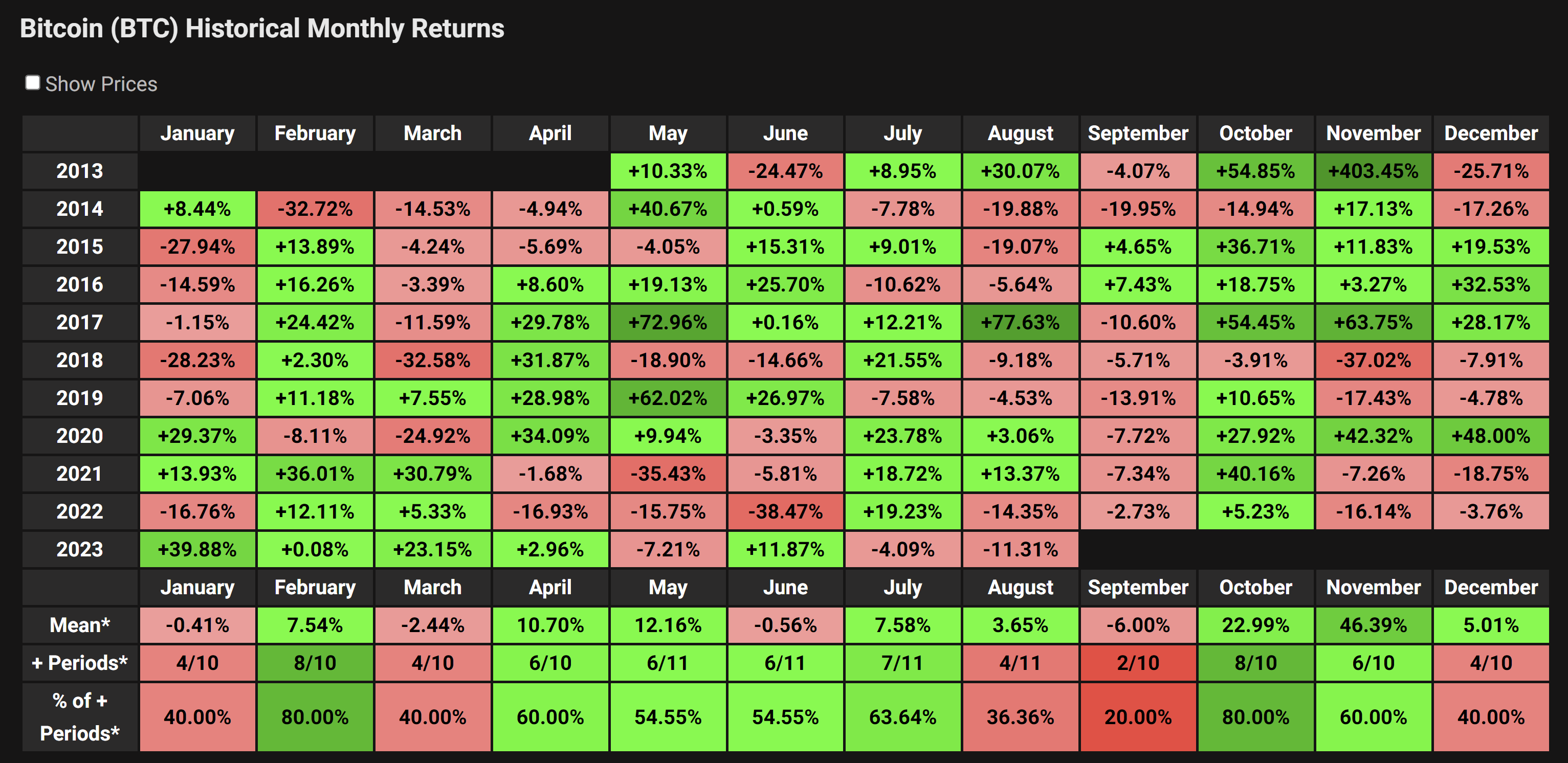

Such sentiments align with long-standing data. Since its inception in 2013, Bitcoin’s fourth quarter (Q4) has consistently outperformed other quarters, recording an impressive average gain of 93.38%. To put this into perspective, the next best-performing quarter, Q2, lags substantially, with an average gain of 33.51%.

In total, BTC has experienced 6 “green” and 4 “red” fourth quarters. In the last bull market, in 2020, it was a whopping +169.45%.

Yet, it’s essential to delve deeper into this data. If we unpack Bitcoin’s historical performance since its inception in 2010, we notice an intriguing pattern. Only on two occasions has Bitcoin recorded profits in both September and October consecutively.

While September 2023 broke its seven-year jinx, it remains to be seen whether October will follow suit. Historically, most BTC cycles have painted September red, followed by a green October. Given this year’s green September, it poses an essential question for traders and investors alike: what’s the probability of witnessing two consecutive months of gains?

3. Macro Events This Week

This week is also dotted with critical macroeconomic events that could significantly influence the Bitcoin and crypto market. Federal Reserve (Fed) chair Jerome Powell is set to speak on Monday, followed by the release of ISM manufacturing data. As the week progresses, Tuesday will witness the unveiling of the JOLTS jobs data, while Wednesday has the OPEC meeting scheduled. The week culminates on Friday with the September jobs report, expected to be the cornerstone event.

The US employment report for September is highly anticipated. Preliminary forecasts suggest the employment numbers could settle around 150,000, a decrease from August’s 187,000. An anticipated drop in unemployment rates from 3.8% to 3.7% and a marginal increase in average hourly earnings (0.3%, up from 0.2%) are also on the cards. Any unexpected surge in these metrics could elevate the US dollar (DXY), conversely negatively weighing in on Bitcoin and crypto prices.

Bonus: More Crypto Stories In The Week Ahead

The forthcoming week is also brimming with more intriguing crypto events and announcements that are eagerly awaited by traders and investors, as outlined by crypto analyst TheDeFinvestor. The spotlight will be on Cosmos (ATOM) as they unveil the Cosmoverse conference, a significant gathering in the Cosmos community scheduled to commence on October 2.

Moreover, the unlocking of approximately $16.6 million worth of SUI on October 3 is on the horizon. This represents about 4% of its circulating supply. The ramifications of such a substantial release could be huge. The beginning of the Sam Bankman-Fried (SBF) trial on October 3 is another noteworthy event, poised to attract a considerable amount of attention.

The realm of DeFi is also buzzing with speculations surrounding dYdX. Given that dYdX V4 is developed on a Cosmos chain, there’s considerable conjecture that the team might disclose the launch date of dYdX V4 during the Cosmosverse conference on October 2-3. While this remains speculative, the plausibility of such an announcement during a major conference makes it a subject of keen interest for stakeholders.

Furthermore, Chainlink’s much-anticipated Smartcon conference is set to begin on October 2. The community is abuzz with expectations of significant announcements concerning Chainlink’s developments, especially with regard to the partnership with SWIFT.

At press time, BTC traded at $28,288.

from Bitcoinist.com https://ift.tt/49trmYs

0 Comments